The big industry captains are preparing to collaborate with Trump. There is the idea that it would be complicated for the U.S. president to impose tariffs on Mexico, as it would be the American companies themselves that would end up paying these taxes. Many U.S. companies export products and supplies from Mexico to their plants in the United States, so they would be the ones affected by the tariffs.

Despite this fact, Trump continues with his idea as his goal is for other companies to follow the example of companies like Amazon or Stellantis and decide to operate mainly from the United States. Although from a rational economic standpoint, it would be beneficial for Trump to negotiate differently with the T-MEC partners and establish tariffs on products imported from China or other regions, so far his decisions have not been based on economic rationality.

There has been an unexpected communication between the United States and Mexico, which has generated some confidence. Although Trump had mentioned the possibility of imposing tariffs on Mexican products, he recently stated that negotiations with Mexico were going well. This sudden change in his statements was a surprise to many and caused a decrease in the value of the dollar against the Mexican peso.

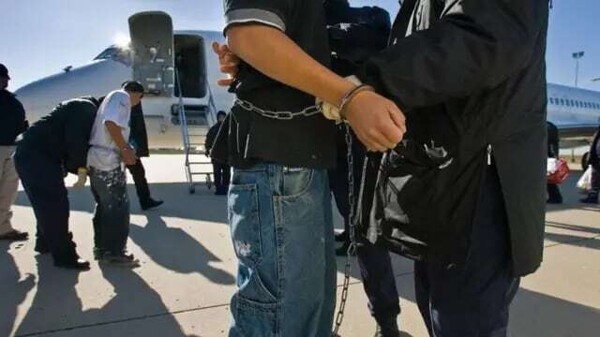

It is evident that there have been signs and messages that have influenced Trump's positive perception of Mexico, such as actions in immigration control, the fight against organized crime, and the regulation of imports from China. Despite the president's volatility, communications seem to have been effective so far. Trump's rhetoric towards Mexico contrasts with his previous positions, suggesting a possible shift in his approach.

Trump has used the threat of tariffs as a tactic to pressure countries like Mexico, Canada, and China to achieve his goals. In the case of Mexico, this could include actions to stop illegal migration to the United States and combat the trafficking of substances like fentanyl. The imposition of tariffs also reflects Trump's perception and his close circle that the U.S. trade deficits are actually subsidies for other countries.

Some companies, such as Amazon, have made decisions that seem to align with Trump's preferences, such as shutting down distribution centers in Canada. Additionally, Stellantis has confirmed the reopening of a plant in Illinois, indicating that they may see advantages in showing cooperation with the U.S. president's policies. These unexpected moves have surprised many investors and will likely continue to be a point of attention in the coming months.